What is TGAP?

The TGAP, or General Tax on Polluting Activities, is a tax which concerns companies with a polluting activity or which use polluting products.

Initially included in article 45 of the finance law for 1999, this tax has been in force in France since January 1, 2000. The objective of the TGAP is to:Optimize waste management, by promoting their sorting, their recycling and their reuse, and to reduce the quantity of non-recyclable waste.

The companies concerned are taxed on the tonnage of waste intended for incineration or landfill. The long-term objective of the TGAP is to reduce GHG emissions by 21 % by 2025 and by 40 % by 2030, compared to 1990.

Who should pay TGAP?

Any company that collection of waste which is subsequently stored and treated must pay the TGAP in 2023. It is the waste operators who collect it, adding the tax to the cost of waste treatment.

Depending on the nature of their activity, some companies may be exempted of TGAP. To find out if your company is one of the exempt entities, go to the public service website.

In some cases, TGAP may concern the individuals. In addition, waste disposal sites increasingly tend to tax their users financially, due to the polluting nature of the treatment of waste deposited there.

What waste does the TGAP apply to in 2023?

The TGAP applies to the products or polluting emissions of companies. Depending on their activity, there are two categories of TGAP:

TGAP “Waste”

The TGAP “Waste” component concerns all activities of storage of hazardous or non-hazardous waste, their treatment (incineration or co-incineration) or their transfer to another country.

- Non-hazardous waste : household waste collected by local authorities. It also includes ferrous and non-ferrous metals, plastics, untreated wood, paper and cardboard, uncontaminated packaging, construction waste, rubble and green waste.

- Waste dangerous : containing toxic or dangerous elements presenting risks to human health or the environment.

TGAP “Non-Waste”

In the TGAP “Non-Waste” component, we find:

- Pollutant emissions: all releases of emissions harmful to the environment, such as sulfur oxides or solvents.

- Laundry: any delivery and use of detergents, washing preparations and fabric softeners, depending on their phosphate content.

- THE extraction materials: any delivery or use of extracted materials of any origin.

The TGAP does not apply to the recycling of materials that have already been sorted, such as paper, cardboard or biowaste.

How is the TGAP calculated in 2023?

The TGAP rate is set each year for each ton of waste. The amount of tax varies depending on the kind of waste concerned and thebusiness activity liable, as well as the type of treatment performed (burial or incineration).

Entities liable for TGAP are required to keep a tonnage registerThis must include the nature of the waste, its treatment, its origin and the identity of the producer.

There statement se made online, on the tax website. The tax is paid in two installments, with a deposit being paid in October. Then, the balance is paid in April and May of the following year.

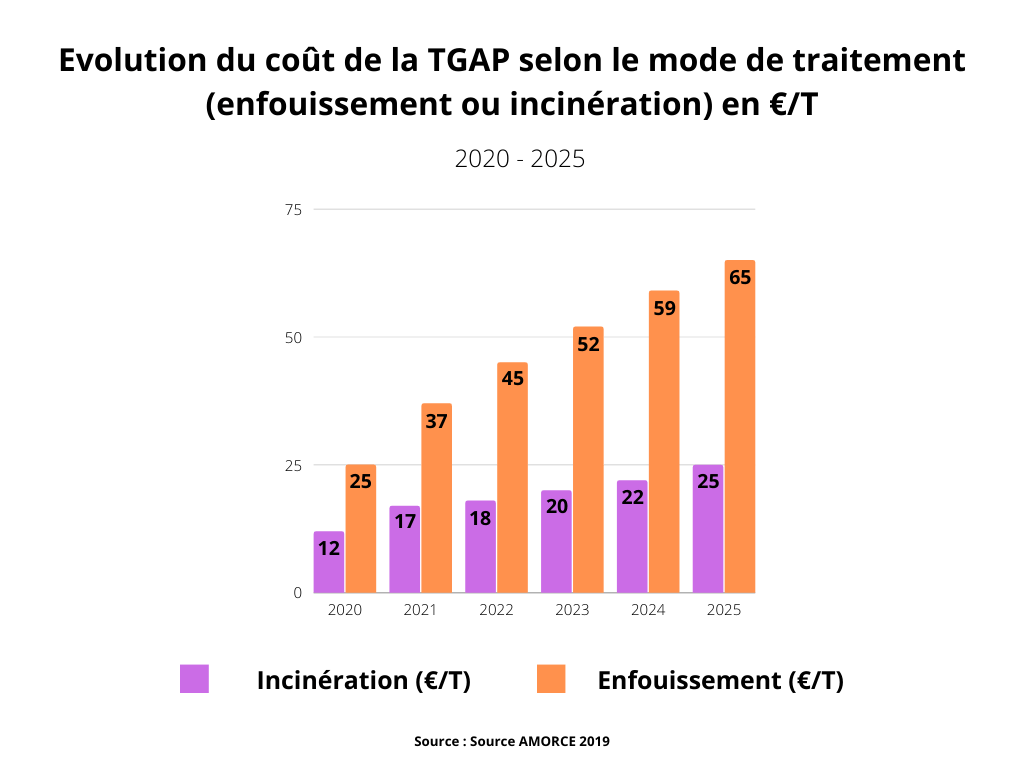

Increase in TGAP

To combat waste and related pollution, the government increase the TGAP rate has increased significantly since 2021The aim of this increase is to limit waste production and encourage recycling.

By 2023, every tonne of non-hazardous waste sent to burial will be taxed at a rate of €52 per tonne. By 2025, the tax will reach 65€. For a ton of waste sent to incineration, the tax currently at €20, will reach 25€ per ton.

Every year until 2025, the TGAP rate will be reassessed upwards. full scale on TGAP rates in 2023 is available on the Official Bulletin of Public Finances – Taxes website.

What impact for communities and waste operators?

THE waste household are considered non-hazardous waste, and are targeted by the TGAP. Their collection is managed either by local authorities, or by public service delegation with waste operators.

THE local authorities are generally not subject to the TGAP, as they are not considered businesses. However, the tax on polluting activities may apply to some of their activities such as waste management. The TGAP may apply to greenhouse gas emissions from the facilities they operate, such as wastewater treatment plants, incinerators, landfills or power plants.

For their part, the waste operators may also be subject to TGAP. The tax applies according to CO2 emissions from incineration waste or methane emissions from dumps.

The increase in the TGAP is synonymous with an increase in the cost of treatment by local authorities and waste operators. It is therefore necessary to reduce waste production and optimize its sorting and recycling. To achieve this, adopting environmentally friendly practices or GHG reduction technologies is essential.

If you found this article helpful, please share it!